www.Restore-America.com: FREE, SECURE; NO Log-In, Sales, Tracking, or Gimmicks (DaveFontaine@Comcast.net)

The US, MA, and CT Treasury Defendants

have blatantly crafted and published

their Omissive FRAUD “Income Tax” Scheme,

evident in all of their public documents

citing 26 USC color-of-law for purported authority,

all designed to coerce your submission

to ABUSE (unconstitutional taxation).

Massive 26 USC Terminology Manipulation (Allegation 09)

and

coerced Employers' / Financiers' Fraudulent REPORTING

bind State(s) and Federal Treasuries in complicity.

Supplemental Publications below,

repetitively included with most received correspondence,

are also packed with Omissive FRAUD:

COERCIVE COLOR-OF-LAW

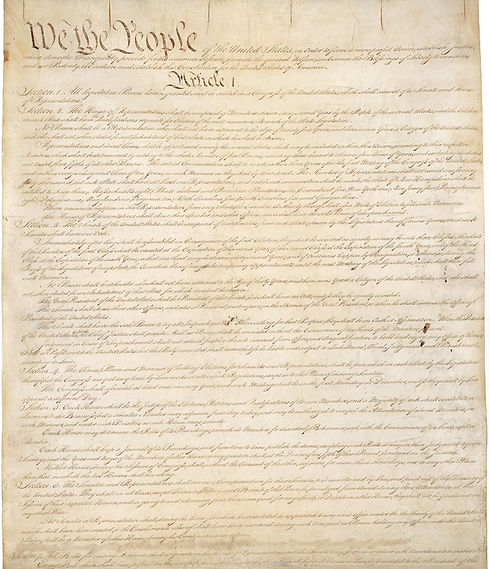

MANIPULATING "WE, the People"

Corrupt Forms fully detailed below:

Federal

1. Perversion of OUR LIBRARY of LAW

2. Coercion to subvert Territorial Limits

3. Coercion to subvert Taxation Limits

4. Coercion to implement Admiralty Law

5. Coercion to Invade State Territory

6. Coercion to Invade Privacy

7. Coercion to Distribute Stolen Property

8. Coercion to Implicate Employers/Financiers

9. Taxing "Fruits of our Labor"

10. Coercion to subvert "Due Process"

11. Coercion to Deprive Rights

under color-of-law

12. Dereliction of Duty, Breach of Contract,

Negligence, Depraved Indifference

MA

CT